Big TFP data mystery! (Probably solved!)

NOTE: Mystery probably resolved! See update below. Here was the original post, for posterity:

I had been under the impression that over the last three decades or so, the rich countries had all experienced similar rates of TFP growth. My source for that was the OECD's time-series on multifactor productivity (another name for TFP). Here is a chart of those OECD productivity numbers since 1985:

As you can see, most rich countries grew their TFP at the same average rate, consistent with the idea that TFP mostly measures technology in the long term, and that technology spreads rather easily between rich countries. A few countries, like Korea, Ireland, and Finland, did much better over this period, and a few countries, like Italy, Spain, and Portugal, lagged behind. But most rich countries were clustered along the same basic line. The U.S., UK, France, and Germany (highlighted on the graph) all stayed very close to each other.

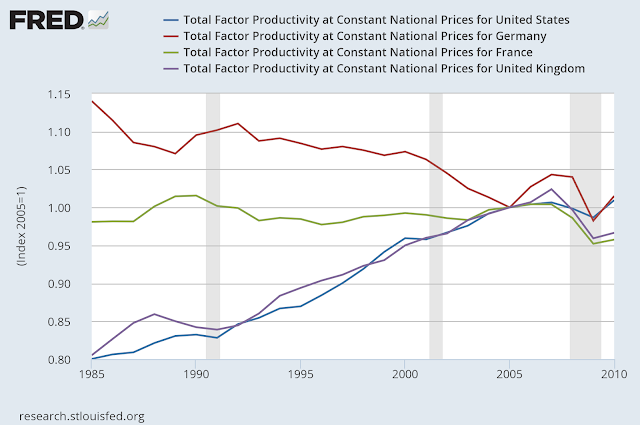

But I now see that FRED has its own TFP numbers for various countries, taken from the Penn World Tables. And here's what happens when I plot the TFP numbers for the U.S., UK, France, and Germany over the same time period (1985-2011):

What??!!

The U.S. and UK lines match up as before, but the Germany and France lines are wildly, totally different! In fact, according to the Penn World Tables, Germany's TFP actually steadily declined from the mid-80s to 2011!

What on Earth is going on here?? Obviously the two measurement methodologies are very different. So I tried to track down the source of the discrepancy, and I found some interesting stuff.

First of all, it turns out that the Penn World Tables, currently assembled by a team of economists from UC Davis and the University of Groningen, have undergone substantial revisions to their methodology in recent years. They switched to a new growth accounting method developed by Francesco Caselli in the early 2000s (which I plan to study in detail when I get the chance). As Antonio, and Marek Jarociński pointed out in 2010, these revisions were enough to substantially change the results of all cross-country growth regressions. Simon Johnson, William Larson, Chris Papageorgiou, Arvind Subramanian criticized the new Penn methodology, and suggested possible changes.

Meanwhile, the OECD methodology for calculating TFP has some questions surrounding it as well. To get TFP you need measures of labor and capital inputs. The OECD uses a pretty textbook method for doing this - simply stick in the raw estimates for the dollar values of labor and capital. But when they tried using another database called EU-KLEMS that tries to adjust for "quality" of inputs, they found totally different numbers.

I am not experienced enough in growth accounting to wade into these disputes in a substantive manner; it would take me at least a month of serious study to be able to say with any confidence which of these methodologies I believe most. The real takeaway here, though, is that TFP measurements are HIGHLY suspect, and will continue to be so for the foreseeable future.

That is bad news for most of modern macroeconomics, both on the growth theory and on the business cycle theory side of things. If differing methodologies for measuring labor and capital inputs diverge by this much, it means that any series you use probably has tons of stuff in it that it shouldn't have. That means that changes in the series at business-cycle frequencies - the good old TFP shocks of RBC models, which are also part of "kitchen sink" DSGE models like Smets-Wouters - are also unreliable. Basically, all those "shocks" are as likely as not to just be noise. That's probably true whether you compare across countries or look only at one country.

So this is a very pessimistic finding, and a huge challenge for the growth accounting field. Hopefully, a meeting of the brightest minds will get to the bottom of the problem and arrive at a consensus solution. If not, it means that any model that relies on measures of aggregate TFP, or factor inputs in general, is unreliable until the accounting problems are worked out.

Updates

Robert Inklaar of the University of Groningen contacted me and explained what was wrong! The most recent version of the Penn World Tables, version 8, did not take into account changes in averaged hours worked in some countries. Also, it used a Barro-Lee data source that apparently had some questionable data on trends in education. Inklaar says that the next version of the PWT, version 9, will fix the problems, and until it comes out, to use OECD data.

Well, I am mostly relieved. It's not really a methodology disagreement (except for the Barro-Lee education data). All of macro does not have to be scrapped, just yet. :-)

Thanks to Robert Inklaar for helping me out!

...But the growth economists I talked to about this mystery all expressed deep skepticism about these TFP data sets in general...

Comments

Post a Comment